Appraising the total value of infrastructure

At our third evidence session we were incredibly lucky to have three very contrasting perspectives of appraising infrastructure in very different settings; the public, regulated and private sectors. The funding driving projects differed significantly between presenters from city deal funding with strings attached, to user charges that were highly regulated, to private finance. Despite the very different finances, the messages were again remarkably clear; we need to capture a range of different forms of value; the process through which we appraise these values needs to change; the rules set at other scales (for example national governance or regulation) can make it hard to appraise projects how we'd like to; we may not have the perfect way to measure and compare values but we need to start with practical expediency and iterate our approaches as methods and skills evolve.

Capturing multiple forms of value

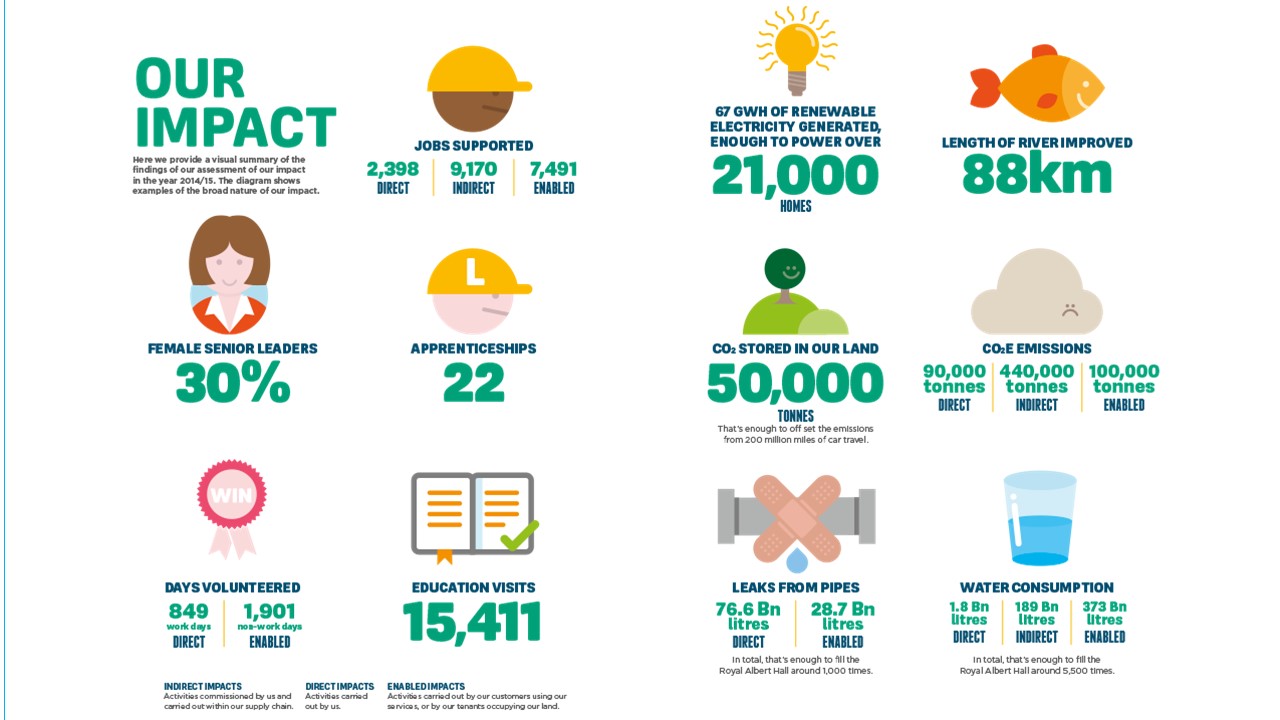

It is becoming widely accepted that infrastructure has the potential to contribute more to an area than jobs and GVA growth. In response to this, all of the organisation presenting had developed systems to articulate what that wider value was. Building on the Natural Capital Protocol, which captures how organisations interact with nature, Yorkshire Water has developed a comprehensive framework that accounts for the natural, social and human impacts of projects and decisions alongside financial assessments. It's 'six capitals' approach is a completely new way to integrate sustainability into core decision processes. Yorkshire water has identified a series of indicators that span the six capitals and has quantified the monetary value of their operations across those indicators in their 'Our Contribution to Yorkshire' report. This monetary impact is supported by qualitative data that uses other metrics and metric include direct, indirect and enabled impact to capture the full range of activities (see figure 1).

Figure 1: Yorkshire Water qualitative contribution to the Yorkshire Region (Source: Our Contribution to Yorkshire, Yorkshire Water, 2018)

This formal approach to value capture is rare, with others using more discursive and iterative processes to identify opportunities to deliver a broader range of value. For example, Sheffield City Region is in the process of developing a 'checklist' of regional outcomes to which project proposers could contribute, building on the Joseph Rowntree Foundation Inclusive Growth Monitor. This aim to articulate the wider and less tangible impacts that 'hard tools' cannot capture. This checklist will form the basis for discussion with project proposers about how projects could be adapted to better contribute to these outcomes and will be used to negotiate their contribution to the city region's aspirations.

This wider conception of value is not new, in fact many large accountancy firms have been promoting total value, true value or total impact for some time. However, the nature of what value is accrued and to whom when considering local infrastructure is very dependent on the place in which any project or strategy is located. Therefore, the approach to defining and measuring value is very place-specific and cannot be standardised.

Appraising multiple forms of value

Once value has been articulated, another challenge is demonstrating how this broader conceptualisation of value is driving decisions. It is all too easy to default to financial value, since this is often the dominant form of value, and because current appraisal systems based on cost benefit analysis prioritise this form of value. Our speakers presented some very innovative ways to manage the appraisal of projects to ensure that the wider view was considered.

The business case process at Sheffield City Region includes a template that requires project proposers to demonstrate how they deliver key benefits to the region. The template forces project promoters to go through a logic chain process identifying the problem (relevant to the region) they are addressing, the solutions that address that problem and the stakeholders that need to be engaged. This allows the City Region to put in place conditions to funding that ensures that the final solution delivers on the key benefits required or to negotiate with project proposers to ensure a more effective outcome for the region. Importantly, these business cases are published to provide transparency and to encourage stakeholders to challenge the proposal.

Yorkshire Water is in the process of enshrining the six capitals approach into decision support software, which will automatically calculate the value of different project options to support decision making. The approach has already been tested on the evaluation of one scheme's contribution to natural capital and used for multi-capital options appraisal on another scheme. The process enabled Yorkshire Water to engage more fully with stakeholders and identify how different options could align with others' priorities.

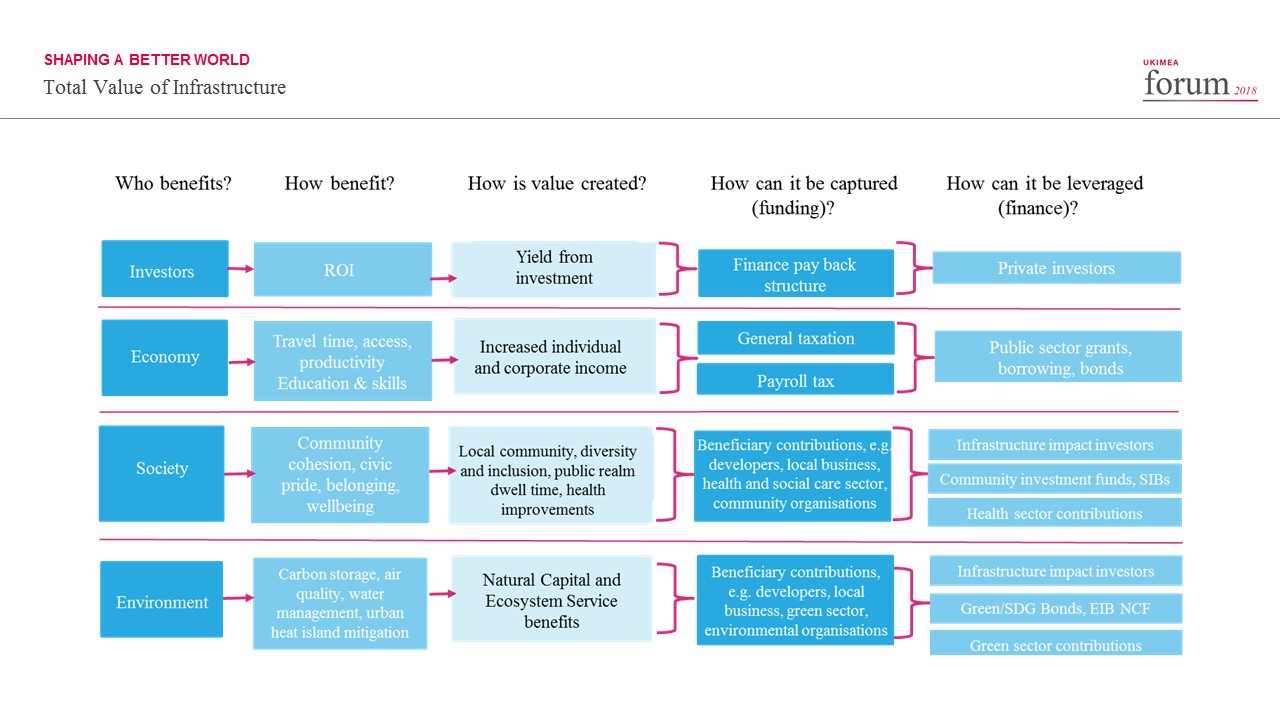

This transparency about what value is created and who benefits from that value is crucial to improving co-ordination between stakeholders. It is an important medium through which to stimulate discussion to identify how investment can be used to maximise the value created by ever dwindling funding. However, the allocation of this value can be problematic. Value tends to be captured when it is funded, (see the very useful figure 2 from Kelly Watson at Arup) and we are getting far better at creating finance mechanisms to capture a broader range of values.

Figure 2: Capturing Total Value (Source: Making the Value Case for Infrastructure, Arup, 2018)

However the relationship between who benefits and who pays is not always linear. Take for example the health benefits of new cycling infrastructure - the transport authority may fund the infrastructure but the health authority may benefit from reductions in coronary disease. This is particularly problematic when there is a lot of time between funding and benefit. More work is needed to understand and manage the transfer of value between organisations in relation to infrastructure.

Constraints at other scales

These approaches to valuation and appraisal have not taken place in isolation, they are all strongly influenced and constrained by rules, standards and guidance at other scales. For example, the funding that Sheffield City Region administers is a portfolio of funds many of which come from central government with strict requirements for job creation and GVA uplift. These funds are also provided on an annual spend-it-or-lose-it basis. Both of these factors strongly constrain how the funds are administered and how projects are evaluated. This can lead to some innovative project bundling to ensure that projects contributing to 'traditional' metrics are balanced with those with a less-direct contribution to jobs and GVA but a more significant contribution to key regional outcomes. The City Region also faced challenges between identifying projects that contribute to city-region priorities and those that contribute to local authority priorities, including balancing outcomes across local authorities.

Some infrastructure sectors are highly regulated and their appraisal and investment processes are strongly influenced by the regulators. In the case of the water sector, the economic regulator, Ofwat, has historically required water companies to demonstrate the financial value of their investment (in line with their role as economic regulators). It has been argued that this has forced a focus on financial at the cost of other forms of value. However, Ofwat has shown support for the six capitals approach and their new resilience duty could encourage a wider perspective.

There is a great deal of focus on justifying returns from infrastructure projects to investors. This too can drive a focus on financial value that can be captured and returned to investors. However, measuring total value can help to identify alternative forms of funding and finance that can support a project more likely to deliver a broader range of values (see figure 2).

Practical expediency

It's is recognised that monetising some forms of value may not be ideal, however, in the interests of practical expediency, many are using this as a way to get social and human value considered at all. In an effort to address this debate, Yorkshire Water has published its quantification methods in detail to encourage debate and challenge. As methods are tested and improve we will develop more sophisticated ways to balance monetary and non-monetary metrics of value. In the meantime, it is important that people become familiar with discussing and debating non-financial value and that means starting somewhere, building capacity and moving towards an ideal approach, rather than waiting until a perfect approach has been developed.